What is Form W-2?

Also known as a Wage and Tax Statement, W-2 is the IRS form employers are required to complete and distribute to their employees by January 31 of each calendar year. Employers also need to file a copy of the form with the Social Security Administration (SSA) by the end of February. Dheera malayalam movie mp4 video songs free download. The W-2 needs to be submitted with an individual’s tax returns. Without it, the IRS will not accept an individual’s income tax return as valid.

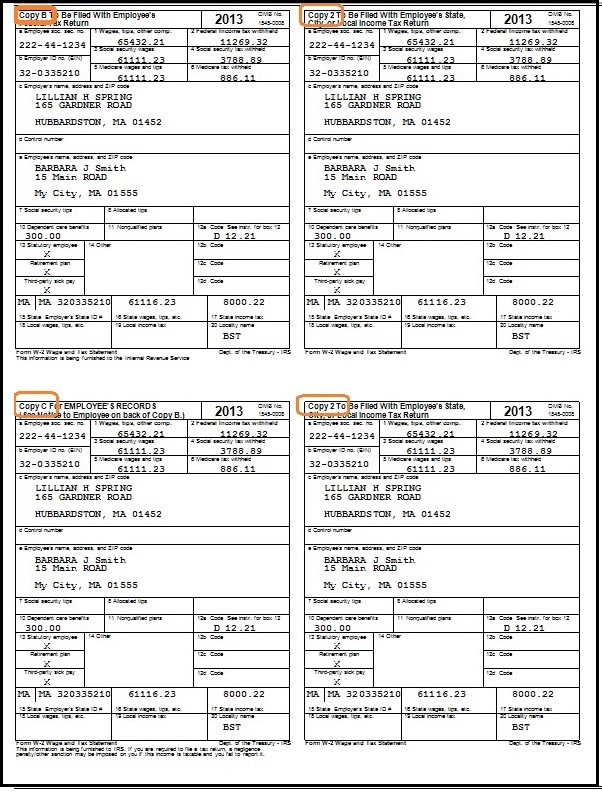

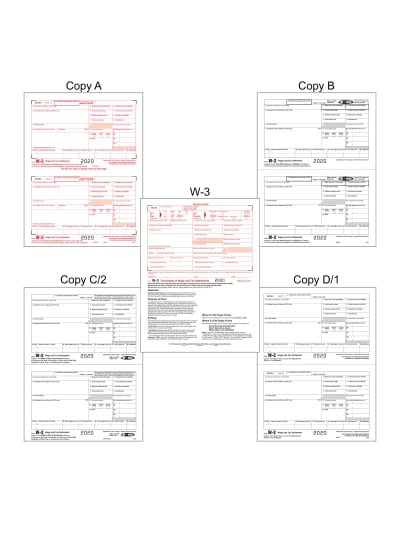

For details explaining the difference between these two print options, see W-2 Print Options in Patriot Software. Click “ Create W-2s. ” A PDF document will download on your computer, showing the W-2 forms in the format you selected, for the employees you selected. The W-2 Professional software is our top choice for the complete spectrum of W-2 reporting to the SSA and states. The W-2 Professional software supports auto-calculating withholding amounts, an unlimited amount of filing entities, and up to 10,000 W-2 tax records/forms before having to purchase bump codes for additional records. Product description No more W-2 and 1099 filing headaches. EzW2 software is approved by SSA to print form W-2 (copy 1, 2, A, B, C and D) and W-3 on white paper from your office laser and ink-jet printer. It can also print 1099-NEC and 1096 forms. EzW2 can support multiple company accounts on the same machine with no extra charge. W-2 Software: W-2 Software to Create, Print & E-File IRS Form W-2 Software to Create, Print and EFile Form W-2 Files SSA Copy A electronically (eFile) via SSA BSO or on SSA approved fillable forms. W-2 forms can be keyed in or imported from text files, spreadsheets and SSA EFW2 transmittals.

Take the Guesswork out of W-2 Form Creation

As a business owner during tax season, in addition to doing your personal and corporate 1040s, you also need to distribute information to your employees via W2 forms – so that they can complete their tax forms.

There’s no need to get bogged down or discouraged by this paperwork,though.

Our fillable forms make it simple to generate and print out W-2 forms for your employees. All you need is basic employment and salary information. Our generator tool calculates the state and federal tax withholdings for you automatically.

W-2 in a Nutshell

W2 is an IRS form employers that are required to complete and distribute to their employees by January 31 of each calendar year.

Employers also need to file a copy of the form with the SocialSecurity Administration (SSA) by the end of February. The SSA uses thatinformation to determine future social security, disability, and Medicarebenefits. Tinn-r for mac.

W-2 forms are different from two other tax forms they are sometimesconfused with, W-9 and 1099 MISC forms. A W-9 form is the form employers haveindependent contractors fill out at the time of hire. That form contains allthe information an employer needs to complete IRS 1099 MISC forms.

The 1099 MISC form is the equivalent of a W-2 form for independent contractors. It reports the amount a contractor earned in a given tax year.

Why do you need to use the W-2 Form?

As an employer, you need a W-2 Form to inform the government how much you have paid to and withheld from each employee. The Form also provides the employee with information that is included in his or her income tax form. For example, how much you have added to your retirement plan, your social security and medical earnings, and even any amount you received for your health insurance. It gives the Social Security Administration and the Internal Revenue Service a clear picture of your income tax returns.

When do you need the W-2 Form?

Your employers (current or former) are generally required to send you the W-2 Form for the previous year by the end of the January. If you don’t have one or can’t get it from your previous employees, you will need to create a W-2 form by yourself.

Contoh program stack pascal.

Are there any deadlines or times when this form is needed?

As an employer, you must complete and distribute Form W-2 to employees by January 31. Form W-2, along with Form W-3, should also be filed with Social Security Administration (SSA) by January 31. This deadline applies to both e-filing as well as mail submissions. If you file after the deadline, it may result in late filing penalties. However, if January 31 falls on a weekend or any national holiday, the deadline will be shifted to the next business day.

What are the main things that go on a W-2 Form?

W2 Printing Software Free

On a W-2 Form you need to include standard information about your employee and business:

- You Business Name, Adress, and State Tax ID Number

- Employees Name, Address, and Social Security Number

- Total wages, Social Security or other compensation

What are the most common mistakes to avoid?

Mistakes made on Form W-2 can cause several confusions and headaches both for employers and employees, even some of which an employer can be penalized for. The most common mistakes to avoid on W-2 Form include:

- Using a form from the wrong year

- Incorrect Employee Names and Social Security Numbers

- Using Titles and Abbreviations in Name Fields

- Missing the Filing Deadlines

- Failing to use Black Ink

- Missing Employer’s Identification Number (EIN)

- Failure to Complete the “Retirement Pan or Medicare Wage” Block

W2 Software Free

Do I need to use a lawyer, accountant, or attorney to help me?

When it comes to taxes, you can do it yourself. Most often, businesses rely on tax professionals like lawyers or legal attorneys to take care of the tedious details of tax and other legal needs. But these legal entities can cost you much. You can save your time, stress as well as money by downloading the form online. There are several web-based software that allows you to download W-2 forms easily and safely. If you opt to access your W-2 online, you have to download and print your own copies. It’s a simple and easier process that eliminates the waiting time for paper copies.

Why use our W-2 Form generator?

Our tool is the simplest, easiest, and the most advanced W-2 generator tool that can help you create a W-2 Form in less than 2 minutes. It will be automatically filled with correct calculations and ready to be sent to your employees. Our tool has a subscription plan so you can create unlimited W-2 forms at a low cost.

Form W-2 FAQs

- What is an IRS Form W-2?

The W2 tax form is a form filed by an employer for an employee to tell the IRS how much he paid the employee that year, how much the he withheld from the employee’s salary and remitted to the government for income, social security or Medicare taxes and contributions that year.

It’s the employer’s job to create and file W2 tax forms. He is also required to give one to every employee, who will then use it for their own tax.

- Who needs a W-2 tax from?

Employees whose employers withheld some amount from their salary for tax purposes need a copy of their W2 forms as filed by their employers. They will need to attach it to their own tax returns when they file them.

Employers, need to make and file one W2 for every employee they paid more than $600 or its equivalent or from whose salaries they have withheld amounts for taxes.

- Are there any deadlines for W-2?

Yes, W2 tax forms should be filed, online or physically on or before the 31st of January of the year after the close of every tax year. The deadline for giving your employees a copy of their W2 as you have filed them is also January 31st.

- What are the main things that go on a Form W-2?

The W-2 tax form, mainly contains details to identify the employer and the employee, of how much that employer paid the employee, and how much tax it has withheld from that employee’s salary.

- How do I create a W-2?

Companies with over 250 employees are required to file W-2s electronically, small business employers can still download and print blank copies of Form W-2 directly from the IRS website. A copy of the Form W-2 can be filled out by hand in accordance to IRS instructions and submitted by mail.

To make this job easier, we have created our Form Pros W-2 generator that auto-fill Form W-2 template based on a simple questionnaire with detailed instructions. No PDF editing software required, just answer a few simple questions about employer and employee, then Download, Print and Mail all required copies.

- Can I create a W-2 online?

Yes, you can create a W-2 form for your employees online. Our W-2 generator is perfect for this, as we’ll guide you through the steps to make sure you don’t miss anything. After answering a few questions, you’ll only need to download, print and file filled copy of the form by mail. Consult IRS website if you want to file Form W-2 electronically.

- Where can I get a copy of my W-2?

You can get it from your employer who is actually required to give you a copies every year to be filed with your Federal and State tax return, as well as a copy for your personal record keeping. Sometimes employers have payroll providers. If your employer has one and is unable to give you a copy of your W-2, the payroll provider might.

- Can you get another W-2 if you lost it?

Yes, you can get another W2 if you lost it - simply ask your employer for another copy. The employer is required to provide it to you. If you your employer fails to give you one and it’s past January 31st, you can ask IRS for help in compelling your employer to do so. You can also get copies of older W-2 tax forms you submitted with your tax return for previous years from the IRS website.