Advanced camarilla mt4 I used to apply the standard pivot factors calculations for a long term. But i used to be never glad with them due to the fact the pivot lines were too a long way apart to be useful to me.

- Advanced Camarilla Formula

- Camarilla Advanced Calculator Formula Chart

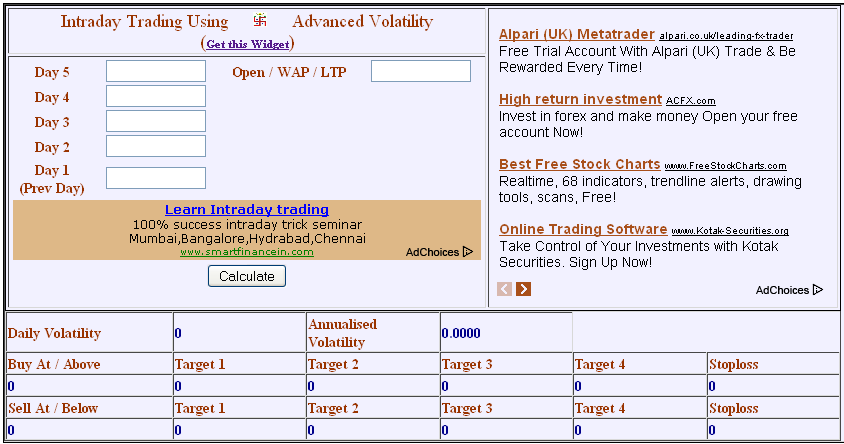

- Calculator

- Camarilla Advanced Calculator Formula 1

Advanced Camarilla Formula

Somehow i found a camarilla pivot points strategy one of a kind set of calculations for pivot points. They are referred to as camarilla stage pivot points.

May 29, 2021 Advanced Camarilla Pivot Calculator If you don’t have the Camarilla pivot points indicator, we recommend using the Camarilla calculator HERE. What we like about this Camarilla pivots calculator is the fact that it comes with an extra two levels of resistance (R5 and R6) and two extra levels of support (S5 and S6). Free advanced camarilla calculator downloads - Collection of advanced camarilla calculator freeware, shareware download - Advanced Hash Calculator, Natural Biorhythms, Advanced Trigonometry Calculator Portable.

You will find the definitions for those pivot points. There’s best 1 calculation that i assume is wrong. This is the calculation of PP (pivot point).

The calculation is the one utilized in calculating the same old pivot point. You can usually be the first one to read my analyses in the technical analysis phase of the admiral markets internet site.

Advanced camarilla mt4 Strategy indicator

Camarilla tiers

There are various forms of pivot point signs to be had inside the world of trading, which include widespread ones, fibonacci, and murrey math.

For me, there’s only one indicator that counts: camarilla. I have been a big fan of the camarilla pivot factor indicator,

for true reasons which we will provide an explanation for in detail underneath. I recollect the camarilla indicator as the nice indicator on the planet for the subsequent reasons:

It identifies assist and resistance;

It facilitates with figuring out the fashion camarilla formula.

It adds confluence to our charts;

It indicates bullish and bearish zones of day and week;

It spots triggers;

It affords clear entry and goes out points.

When you take a look at the template that i exploit you will see even more key benefits to you as a dealer:

Camarilla trading system equation indicator mt4

Ranges are generated automatically each trading day;

It absolutely supports pre reality analyses, which i make for you every day. It is clear and concise. The chart remains simple with camarilla traces.

Source: EUR/USD, m15 chart, admiral markets platform, October 31 2017

Without a doubt positioned, the camarilla indicator gives well respected, simple, and automatic tiers of guide and resistance.

Camarilla pivot points strategy:-

When I started out trading, a friend of mine as soon as told me that camarilla is likewise utilized by some bank and institutional buyers.

We are able to without problems discover tiers of aid and resistance and right here’s how: Android 8.0 download zip.

The h3 and l3 are variety ranges.

Camarilla pivot points indicator Rule

Rate is in range or consolidation camarilla pivot points indicator whilst it’s in among the h3 and l3 degrees. Traders can use those degrees as a ruin or leap stage.

Microsoft 2006 product key. I constantly try to study the better time frame pivot point indicator for mt4 free download then look for a breakout if a fashion is visible on a higher time frame.

Camarilla stages are the primary supply of the confluence that i am seeking out while analysing and trading.

Fibonacci projections

Fibonacci are the third device for recognizing the confluence. After I see that the charge respects a fibonacci degree, i recognize that odds are stacked in my favor. 23.6 – shallow retracement.

The rate usually leap camarilla calculator off from 23.6 in very strong traits 38.2 50.0 61.8 – fundamental fib ranges.

Advanced camarilla mt4 indicator

Fee will mostly react at those ranges. 78.6 88.6 – deeper retracement. These are very strong fib ranges and fees generally tend to react the most at those degrees.

The 88.6% is my preferred fib retracement. The extent is derived camarilla formula by taking the golden ratio, 0.618; square rooting Camarilla macd it and rectangular rooting it again to get 0.886. Add it to your chart and spot it in motion.

Having trouble following the topic of discussion when someone throws out the words “Camarilla Equation” at your local trader happy hour? Relax. I’ve got a quick primer for you that will remove the cloak of secrecy from this fascinating price-based indicator.

Simply put, the Camarilla Equation is a price-based indicator that provides a series of support and resistance levels, much like the Floor Pivots indicator. However, what makes this indicator unique is the fact that each pivot carries a specific call to action. That is, this indicator is usually color-coded to indicate whether you should buy or sell at certain pivot points. We’ll get to this in a moment.

The equation takes the prior day’s high, low, and close prices to determine ten key levels on your charts; five support levels (L1 to L5) and five resistance levels (H1 to H5). The equation is as follows (keep in mind that RANGE is the high price minus the low price of the prior session):

Camarilla Advanced Calculator Formula Chart

The Camarilla Equation offers a powerful method of trading the market because the call to action is always the same. The equation forces you to recruit your inner discipline to trade on the right side of probability. Traders take similar positions at each level, thus creating a powerful form of self-fulfilling prophecy. Moreover, the pivot levels in the indicator are usually color-coded to remind you which actions to take when certain pivot levels are tested. For example, the H3 and L4 pivot levels are typically colored red because these are the zones where you should be looking to sell the market. Likewise, H4 and L3 are typically colored green to indicate long action levels.

If you take action at the third layer of the indicator (ie: sell at H3, or buy at L3), your target then becomes the opposite pivot point. Therefore, if you sold at H3, then L3 becomes your target. If you bought at L3, then H3 becomes your target. In essence, the third layer of the indicator is usually reserved for reversal plays.

The fourth layer of the indicator (H4 and L4) is usually reserved for breakouts, although these levels can offer razor sharp reversal opportunities as well. If you play a bullish breakout through the green H4 level, then H5 becomes your target. If you play a bearish breakout through L4, then L5 becomes your target. Keep in mind that the fifth layer of the indicator can have varying formulas, depending on which version of the equation you find.

The first and second layers of the indicator (L1, L2, H1, and H2) are typically ignored and generally not even plotted. However, I will explain the best times to use these “hidden layers” in a future blog post.

Take at look at the 5-minute chart of MasterCard, Inc. (ticker: MA) for a brief diagram of the types of opportunities you can find using the Camarilla Equation.

Remember, this is a very basic look at the Camarilla Equation. Much like the other forms of price-based indicators I use, the Camarilla Equation lends itself perfectly for higher levels of analysis, like pivot width analysis, pivot trend analysis, and two-day pivot relationships. I’ll break these concepts down in future blog postings.

Now that the cloak has been removed, what do you think? Disk speedup serial key.

Calculator

Frank Ochoa

PivotBoss.com

Camarilla Advanced Calculator Formula 1

Follow Frank on Twitter: http://twitter.com/PivotBoss